Transparency in Ad Monetization: How to Calculate Your True Ad Revenue Performance

December 30, 2025

Editorial Policy

All of our content is generated by subject matter experts with years of ad tech experience and structured by writers and educators for ease of use and digestibility. Learn more about our rigorous interview, content production and review process here.

Key Points

- Real-time visibility matters: Publishers need instant access to revenue data, not 24-48 hour delays that make optimization impossible

- Track attribution accurately: Knowing which specific changes drove which results separates guesswork from strategic decision-making

- Monitor comprehensive KPIs: Going beyond basic CPMs to track fill rates, viewability, and time-to-auction metrics reveals hidden revenue opportunities

- Demand transparent reporting: Your monetization partner should show you every optimization, every setting change, and every performance variable in real time

Stop Guessing, Start Knowing

Here's a fun fact that's not fun at all: most publishers have no idea what their real ad revenue performance looks like. Sure, they've got a dashboard somewhere showing numbers. Those numbers might even be accurate. But do those numbers tell the complete story about where revenue comes from, where it goes, and what's actually working?

Spoiler alert: they don't. Most ad monetization platforms treat transparency like it's optional, giving publishers just enough data to feel informed while hiding the settings and decisions that actually drive revenue. That's not transparency. That's theater.

Real transparency in ad monetization means seeing every decision, tracking every change, and understanding every result. It means having the tools to calculate your true performance instead of accepting whatever numbers get dropped into a dashboard. Let's talk about how to actually do that.

Understanding True Revenue Performance vs. Reported Numbers

Revenue reporting in ad tech has more layers than your favorite seven-layer dip, and each layer takes a cut. Publishers often focus on gross revenue numbers without understanding the deductions, fees, and hidden costs that transform that impressive top-line figure into actual money in the bank.

True revenue performance calculation starts with understanding what happens between dashboard reports and bank deposits. The key deductions you need to track include:

- Demand partner deductions: Additional fees taken by SSPs, exchanges, and other intermediaries before money reaches you

- Discrepancy adjustments: Differences between what platforms report and what advertisers actually paid, usually resolved in the advertiser's favor

- Operational costs: The real expense of managing your ad stack, including tools, personnel, and technology investments

The math here isn't complicated, but it requires visibility that most platforms don't provide. You need to see every fee, every deduction, every adjustment, and every reconciliation in real time, not weeks later when your finance team is trying to close the books.

“It just started to make more sense to find an all-in-one provider to beat our expenses with in-housing. We wanted more flexibility, automation, and technology stack support with a partner like Playwire.”

Ramsey Moshen

CEO, Everhance

The Essential Metrics That Actually Matter

CPM gets all the attention because it's easy to understand and compare. Higher number equals better performance, right? Well, sometimes. But CPM without context is like judging a car by its top speed while ignoring fuel efficiency, safety ratings, and whether it actually starts on cold mornings.

Comprehensive ad revenue performance tracking requires monitoring the metrics that most publishers ignore:

- Fill rate by placement: How many ad opportunities actually generate revenue versus sitting empty, broken down by specific ad units

- Viewability percentage: Whether ads actually appear on screen where they can be seen, not just whether they loaded technically

- Page load impact: How your ad implementation affects user experience and audience retention

- Content layout shift: The visual stability of your pages as ads load, directly impacting both UX and revenue

Then there's the metrics that connect to user experience. A 50% CPM increase means nothing if you've scared off 30% of your audience with aggressive ad layouts.

Read our Guide to Monitoring Ad Revenue Metrics.

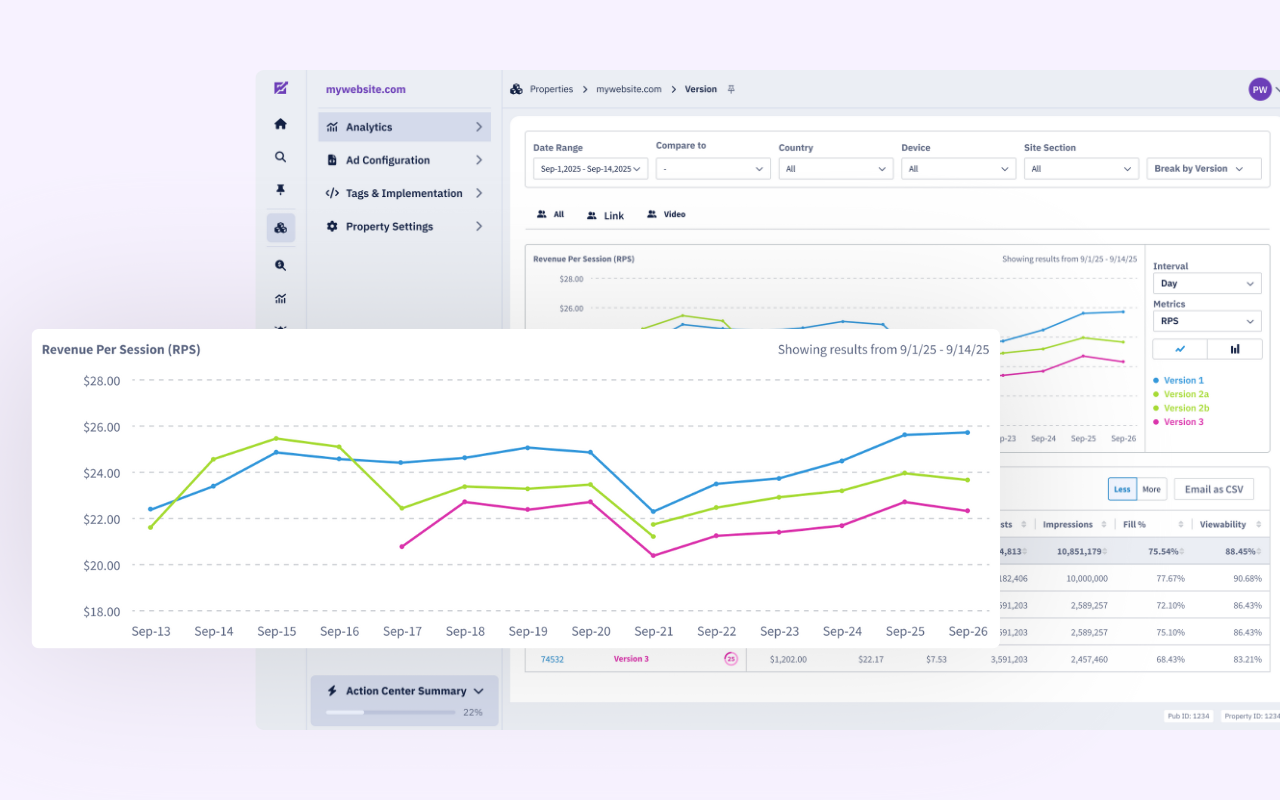

Building Your Revenue Attribution Framework

Attribution is where transparency separates the adults from the children in ad tech. When you make a change to your ad stack and revenue goes up (or down), you need to know exactly which change drove that result. Not "probably this thing" or "we think it might be related to" but definitive cause and effect.

Effective revenue attribution requires three components that work together:

- Controlled testing environments: Isolate variables through proper AB testing where you can attribute results to specific changes, not seasonal fluctuations or traffic variations

- Comprehensive data collection: Track every relevant metric before, during, and after changes, including user behavior, revenue performance, and technical metrics

- Statistical rigor: Separate real results from random noise using proper sample sizes and confidence intervals, not gut feel and wishful thinking

Most platforms offer none of these. They make changes, revenue fluctuates, and everyone just kind of agrees that the changes probably helped.

This isn't good enough. Publishers need to run controlled tests with meaningful sample sizes, track performance at granular levels instead of site-wide averages, and access raw data that shows exactly what happened when. Without these capabilities, you're not calculating revenue performance. You're just watching numbers change and hoping for the best.

The Data You Need to Track Daily

Smart publishers don't wait for monthly reports to understand performance. They monitor key indicators daily, catching problems before they cost serious money and capitalizing on opportunities while they're still available. This requires access to real-time data across multiple dimensions.

Your daily tracking dashboard should include these critical metrics:

- Revenue by traffic source: Separate direct, social, search, and referral traffic because not all visitors monetize equally

- Performance by ad unit: Track CPM, fill rate, and viewability for each placement to identify underperformers quickly

- Demand partner contribution: Monitor which partners fill your inventory effectively and which are just taking up auction time

- Geographic performance breakdown: Understand which regions drive premium revenue to inform content and acquisition strategy

- Viewability and engagement rates: Track whether ads are actually seen and whether users engage with your content despite ad presence

These metrics need to be available in real time, not 24-48 hours later when the opportunity to optimize has passed. Delayed reporting isn't just inconvenient. It's expensive.

Geographic performance deserves special attention because CPMs vary wildly by location. Understanding which regions drive premium revenue helps inform content strategy, user acquisition spending, and even posting schedules. But you can't make these decisions if your reporting platform shows you aggregated global numbers without regional breakdowns.

Read all blogs in the Transparency in Ad Monetization series:

Common Revenue Leaks and How to Spot Them

Revenue doesn't just disappear. It leaks through cracks in your monetization strategy that most platforms won't tell you about. These leaks come in many forms, and spotting them requires the kind of granular visibility that transparent platforms provide.

The most common revenue leaks that cost publishers serious money include:

- Timeout misconfigurations: Auction timeouts set too low cut off premium demand before they can respond, hanging up on advertisers willing to pay more for just a few hundred extra milliseconds

- Price floor mistakes: Floors set too high sacrifice fill rate while floors set too low leave money on the table, and dynamic floors without visibility are just algorithms you're trusting blindly

- Identity solution waste: Multiple identity providers that cost per impression while delivering minimal CPM increases, eating revenue faster than they generate it

- Inefficient demand waterfalls: Sequential auction setups that miss opportunities for true competition, letting lower-paying demand win when premium buyers never get a chance to bid

- Lazy refresh implementations: Refresh rates that annoy users without generating meaningful incremental revenue, destroying long-term value for short-term gains

Transparent platforms show you these settings and let you test different configurations. Opaque platforms set these parameters and never mention them again.

Calculating Your Real Performance Benchmarks

Industry benchmarks are useful until you realize they're averaging together completely different publishers with different audiences, different content, and different monetization strategies. Gaming publishers shouldn't compare themselves to news sites. Education content doesn't monetize like entertainment. Geographic mix matters. Traffic sources matter. Everything matters.

Real performance benchmarks come from your own historical data and controlled testing. Track your performance over time and establish your own baseline metrics. What's your average CPM by traffic source? What's your fill rate variance by time of day? How do different content categories perform? These answers come from your data, not industry reports.

Competitive benchmarking works when you're comparing similar publishers in similar verticals with similar audience profiles. Even then, take the numbers with appropriate skepticism. Publishers don't always report numbers accurately, and reported revenue often excludes the fees and deductions that matter most.

The Technology Requirements for Transparent Reporting

Transparency isn't just about showing data. It's about providing tools that let publishers analyze that data effectively. Spreadsheets don't cut it when you're managing complex ad operations across multiple properties. Publishers need real business intelligence tools built into their monetization platform.

A truly transparent reporting system must provide these capabilities:

- Custom report building: Create reports that slice data exactly how you need, not just pre-built dashboards that answer someone else's questions

- Dimensional analysis: Filter and segment performance across traffic sources, geographies, content types, devices, and time periods simultaneously

- Historical comparison tools: Compare current performance against any historical period to identify trends and validate optimization impact

- Export and API access: Pull data into your own business intelligence tools to combine ad revenue with audience analytics and content performance

API access matters more than most publishers realize. The ability to pull your monetization data into your own business intelligence tools means you can combine ad revenue data with audience analytics, content performance, and user acquisition costs. This holistic view reveals insights that siloed reporting can't provide.

Making Transparency Work in Your Favor

Transparent reporting only matters if you actually use it. Publishers with access to comprehensive data but no strategy to act on insights waste the opportunity. The goal isn't just seeing what happened, but understanding why it happened and what to do next.

Turn transparent data into strategic advantages with these practices:

- Weekly performance reviews: Look beyond whether revenue is up or down to identify patterns in your data and document what optimizations consistently deliver results

- Automated monitoring: Set up alerts for significant deviations from normal performance so you catch fill rate drops or traffic source problems immediately

- Optimization documentation: Track which changes worked, which failed, and why so you make increasingly informed decisions over time

- Competitive testing protocols: Use your historical data as the baseline for evaluating new demand partners or ad formats with rigorous AB tests

- Cross-functional data sharing: Combine monetization data with content, audience, and product metrics to make holistic business decisions

Publishers with comprehensive historical data can run rigorous tests that definitively prove value. Publishers flying blind just make their best guess and hope.

Key Performance Indicators Comparison Table

Metric Category | Standard Reporting | Transparent Reporting | Strategic Value |

Revenue Data | Delayed 24-48 hours | Real-time updates | Immediate optimization opportunities |

CPM Tracking | Site-wide averages | By traffic source, geography, content type | Targeted optimization strategies |

Fill Rate Analysis | Overall percentage | By demand partner, ad unit, and time | Identify underperforming inventory |

Attribution | Estimated impact | Controlled AB test results | Definitive optimization decisions |

Fee Transparency | Quarterly statements | Real-time deductions visible | Accurate financial planning |

Optimization Visibility | Hidden black box | Every setting change documented | Full control and understanding |

When Transparency Becomes Your Competitive Advantage

Publishers with transparent monetization platforms make better decisions than publishers flying blind. It's not complicated. When you know exactly how your ad stack performs, which optimizations work, and where revenue comes from, you can make strategic decisions instead of hoping for the best.

This advantage compounds over time. Each optimization builds on the last. Each insight informs the next decision. Publishers working with transparent platforms continuously improve their monetization strategies while publishers on opaque platforms repeat the same mistakes because they don't have the data to learn from them.

The transparency gap between platforms is widening. Some platforms treat openness as a competitive advantage, building tools that empower publishers with comprehensive data and control. Others treat transparency as a threat, hiding settings and limiting reporting because informed publishers ask harder questions and demand better results.

“I can’t overstate how important the data provided by RAMP’s Advanced Yield Analytics is for me as a publisher. It is something I’ve never seen before but always wanted. Now that I have it, I feel like I have been flying blind for the past 21 years.”

Jordan Greer

Owner, GTPlanet

The Playwire Difference in Revenue Transparency

Every publisher deserves to understand exactly how their ad stack performs. That's why Playwire built RAMP Self-Service with transparency as a core principle, not an afterthought. Publishers working with Playwire see every optimization, every setting change, and every performance variable in real time.

Our analytics platform provides comprehensive reporting that goes far beyond basic CPMs and fill rates. Publishers can track performance across hundreds of dimensions, create custom reports that answer specific questions, and access the raw data they need to make informed decisions. When our yield team makes optimizations, you see exactly what changed and why.

This commitment to transparency extends to our AI and machine learning algorithms. While many platforms hide their optimization logic in black boxes, we show publishers how our AI makes decisions and let you override those decisions when you have better information. Your ad stack, your rules, your visibility.

Calculate Your True Performance Today

Stop accepting whatever numbers your current platform drops in a dashboard and start calculating your true revenue performance. Real transparency means seeing every setting, tracking every change, and understanding every result. Anything less is guesswork dressed up as reporting.

The publishers winning in ad monetization aren't necessarily the biggest or the oldest. They're the ones with the best data and the tools to act on it. Transparent platforms give you that advantage. The question is whether you're ready to use it.

-1.png?width=800&height=157&name=1-playwire-logo-primary-2021%20(1)-1.png)