Online and Mobile Ad Revenue Statistics

September 18, 2024

Editorial Policy

All of our content is generated by subject matter experts with years of ad tech experience and structured by writers and educators for ease of use and digestibility. Learn more about our rigorous interview, content production and review process here.

Key Points

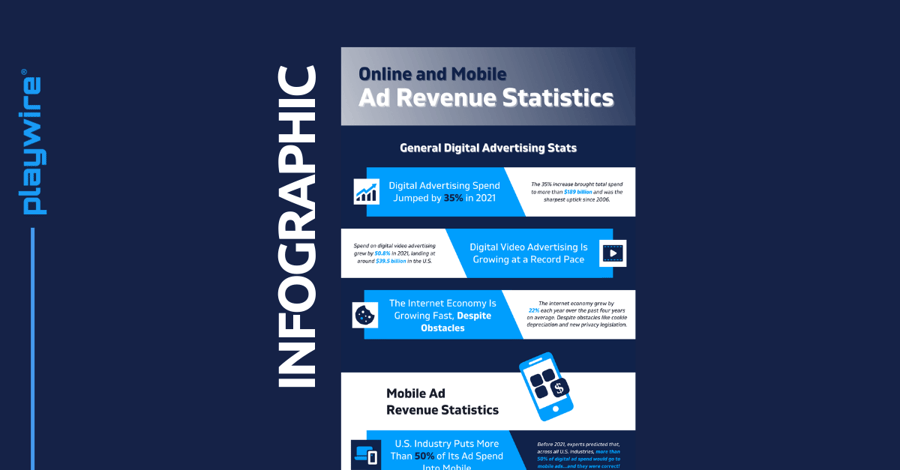

- Despite taxing market challenges like inflation, interest rates, and regulations, the digital advertising industry continues to see storied growth.

- If there could be a star of the ad tech show, mobile advertising would win (naturally).

- Though not growing as rapidly, with the right strategies in place, desktop advertising still introduces unique revenue opportunities for publishers.

- You can earn a bigger share of the ad revenue pie with an established ad monetization partner by your side, like Playwire.

For publishers, advertising revenue makes the world go round. It’s the bread and butter of the various monetization strategies you can implement.

Why? Because it's one of the most lucrative and scalable business models available. And no, we're not just saying that because we've got skin in the game – we've pulled together the ad revenue statistics for desktop and mobile publishers to prove it.

So if you're here to determine whether investing in digital advertising strategies and optimizations is worth it, you're in luck. We've compiled a list of the most compelling, perhaps even shocking gasp, ad revenue statistics to show the future of digital advertising is brighter (and stronger) than ever.

Quick sidebar – why should you care about these numbers?

Because they can directly impact the money in your pocket (okay, let's be real, your online bank account; we're in a digital-first world, after all).

Let’s explore several key online and mobile ad revenue statistics you need to know.

If you're not already partnered with Playwire to maximize your digital advertising revenue through our proprietary Revenue Amplification Management Platform – RAMP® – you're probably leaving ad revenue on the table. And that's no fun. Contact us to learn more about how we can help!

The State of Digital Advertising: Key Industry Statistics

Though the digital advertising industry is poised for growth, it certainly ran into its fair share of potential roadblocks in the last year: inflation, rising interest rates, job cuts, emerging technology, fierce competition, new regulations, and cookie deflation, just to name a few.

Even still, it's coming out on top with digital ad spending continuing to climb.

Total Industry Ad Revenue Reached $225B

"Record breaker" sounds good, and that's exactly what happened in the ad tech industry last year.

Despite fear-mongering media headlines heralding the death of digital advertising, the industry as a whole has been increasing at a steady (and rather impressive) pace.

According to the latest Internet Advertising Revenue Report from PwC, the digital advertising industry boasted record-high revenue in 2023, $225 billion, marking a 7.3% increase year over year. This growth in digital advertising revenue showcases the resilience and adaptability of the industry.

And it has no plans of slowing down.

Statista predicts that the industry could see digital advertising revenue numbers as high as $600B by 2027 – that's not something you want to miss out on.

Buyers Padded Their Projected Digital Ad Spend to +11.8%

They say you've gotta spend money to make money. And ad buyers are taking that message to heart, as confirmed by the IAB's 2024 Outlook Study, which provides industry leaders with insights into ad spending and growth opportunities.

The data found that media buyers increased their 2024 ad spend projections from +9.5% in December 2023 to +11.8% as of August 2024. This increase in digital ad spending is likely thanks to a growing economy, a boost in consumer spending, and cyclical events like the Olympic games and the 2024 presidential election.

Who Runs The World? Video Ads.

It's the content format on everyone's lips; video advertising now accounts for 23.2% of all digital advertising revenue, according to the same IAB Internet Advertising report above. This format alone, including Connected TV (CTV) and Online Video (OLV), raked in $52.1 billion in 2023 and secured a 10.6% year-over-year growth rate.

This rapid growth has media buyers' attention. Digital video ad spending increased 15% last year and is expected to grow 16% this year, to $63B. The surge in video ad spending is a clear indicator of where the digital advertising market is heading.

Plus, video ads as a format are projected to grow 80% faster than total media overall.

There's nothing else to say besides, it's time to get in front of the camera!

The Social Ad (Billionaire) Comeback Kid

Everyone loves a good comeback story, and that's exactly what happened with social media advertising revenue this past year. Even though social media ads slowed down in 2022, they absolutely rallied in 2023, putting up big numbers, like $64.9 billion – an 8.7% year-over-year increase. We've got an increase in ad spend on user-generated content (UGC) and international e-commerce revenue to thank for that bump.

-- Article Continues Below --

The Complete Ad Revenue Resource Center

Mobile Ad Revenue Statistics

There is a goldmine of opportunities available for publishers in mobile ad spending, especially given people's mobile-leaning preferences.

If you're looking for reasons to optimize your content for mobile devices and tap into the mobile advertising boom, look no further.

U.S Industry Invests Big in Mobile Ad Spend

Follow the money and see where it goes – and it goes mobile, at least in the United States. Research shows that mobile advertising made up 66% of the total digital ad spend last year, showcasing a more-than-promising opportunity for hopeful publishers.

If you haven't already, now's the time to consider the potential app revenue you could secure through mobile app advertising.

And the future of mobile advertising is only getting bigger (ironic, right?). Statista predicts that mobile ad spend will comprise 73% of total digital ad spend by 2028, highlighting the growing importance of mobile devices in the digital advertising landscape.

Small Screen, Big Stage: Mobile Ads Go Global

The numbers (and stakes) just keep increasing for mobile ad revenue opportunities. Global mobile ad spending jumped to $360 billion, and experts predict it will surpass $400 billion in 2024, an 11% increase year-over-year. This surge in mobile ad spending reflects the increasing dominance of mobile devices in our daily lives and the shift in digital advertising strategies to reach consumers on these platforms.

Keep Your Antenna Up for In-Game Ads

Yes, mobile advertising spending is set for a healthy growth trajectory. But where should you focus your efforts? In-game ads are certainly one piece of the revenue puzzle, especially as mobile gaming continues to grow.

The global in-game digital advertising market is projected to reach just over $109 billion by the end of the year. And the data trends suggest further growth spurts, predicting a market volume of $145 billion by 2027. This growth in mobile ad spending within gaming apps represents a significant opportunity for publishers and advertisers alike.

-- Article Continues Below --

Game Monetization Guide: Monetizing with In-Game Advertising

Desktop Ad Revenue Statistics

Don't get distracted by "shiny toy" syndrome and put all your eggs in the mobile basket that you forget about desktop ad revenue – because it's not going anywhere; at least, that's what the numbers say.

Desktop Ad Revenue Is Still Increasing

Okay, it's not increasing nearly as rapidly as mobile (and doesn't garner nearly the same media attention), but desktop ad revenue is still important for publishers to consider. Data from the Pew Research Center shows that desktop advertising experienced a healthy bout of growth year-over-year. Plus, between 2016 and 2020, total U.S. desktop ad revenue jumped from $31.1 billion to $40.6 billion.

While mobile devices dominate the digital advertising landscape, it's crucial not to overlook the continued importance of the desktop environment in a comprehensive digital ad spending strategy.

Desktop Display Isn't "Dead"

We wouldn't bait you with that kind of hook.

There are so many new and exciting ad units to help publishers secure the coveted premium brand revenue, but there's still something to be said for the old standby, the tried and true: desktop display.

Between 2019 and 2020 (the latest year for which data was available), desktop display revenue increased by 15.4% to reach a total of around $44 billion. Despite innovative ad units and a rise in video spend, display's total market share even increased slightly year over year, showcasing its resilience in the face of changing digital advertising trends.

Don't Count Out The Digital Video Ad

Although mobile video grabs all the headlines and much of the attention of big brands, it's a mistake for a publisher to leave out digital video content for desktop. While this segment claimed a relatively modest $7.7 billion in digital ad spending in 2020, that figure represented year-over-year growth of 10.5%.

As digital advertising continues to evolve, video ads remain a crucial component of both mobile and desktop strategies, contributing significantly to overall digital advertising revenue.

Grow Your Ad Revenue with Playwire

This industry – our industry – is ripe with potential.

Can't you taste it?

As digital ad spending (and ad revenue) increases across both mobile and desktop platforms, publishers need to be ready to capitalize on these opportunities. And it's a lot easier to do that with the right tools and partner on your side.

So, when you're ready to increase your earning potential and make the most of the booming digital advertising market, Playwire is here to help you do it. We employ the best minds across the ad tech landscape to build innovative solutions that pair machine learning with human intelligence. And there's only one end goal: Pushing your digital advertising revenue through the roof and reaching new heights every single day.

Let's make that happen together. Contact our team today and discover how we can help you navigate the complex world of digital advertising and maximize your digital ad spend across all environments.

-1.png?width=800&height=157&name=1-playwire-logo-primary-2021%20(1)-1.png)